How to Know When You Should Pay Escrow or Principal

Your abode is i of the most expensive purchases you'll ever brand. The costs of buying a business firm, paired with additional abode expenses like property taxes and dwelling house insurance, add upward pretty quickly. The good news is that you likely don't demand to manage all of these expenses on your own.

Whether you're still in the process of endmost on your new domicile or yous've already started making mortgage payments, you've probably heard your mortgage lender discussing escrow accounts. These are accounts set upward to either agree your good-faith deposit until you shut on your home or manage your homeowners insurance and belongings tax payments.

Only what happens if you observe yourself in an escrow shortage? How practice escrow shortages occur? And what's the best way to pay your escrow shortage off?

Escrow accounts—and escrow shortages—can seem complicated. But with Insurify, they don't have to be confusing. Keep reading for our total guide on escrow shortage to acquire how information technology happens and how to pay it and then you lot tin can become back to enjoying your home in no fourth dimension.

Types of Escrow Accounts

Before tackling your escrow shortage head-on, it's important to know what escrow is and to understand the difference between the two types of escrow accounts.

Escrow is a legal organization where an outside party—in this instance, a mortgage lender or loan servicer—holds a large sum of money until a specific condition has been achieved. The specific condition yous need to reach before your escrow account can exist airtight depends on which type of escrow account yous have.

The first type of escrow account is set up when you lot first purchase or refinance your dwelling house.

Earlier closing on a home, most homebuyers make a good-organized religion deposit (also known as "hostage money"). Since you make this payment earlier you close on your new home, an escrow account is created to protect the deposit, the home buyer, and the seller until the purchasing process is consummate. Escrow accounts created during the home-ownership process essentially hold onto earnest money while it is neither yours nor the sellers.

Once you close on your home, the eolith will be used toward your down payment. If you don't end upward purchasing the home, the existent manor agency or seller will apply the deposit to cover the costs associated with relisting the dwelling house. The funds in this type of escrow business relationship may stay there later endmost for various reasons based on your agreement with the seller. If you are building a new home rather than purchasing a dwelling from a existent estate agent, funds may remain in your escrow business relationship until yous terminate signing off on all the piece of work to exist completed for your new dwelling house.

The second blazon of escrow account is set up to be used for the duration of your home loan, rather than during the purchasing process.

Your mortgage company or home loan servicer may require you to have an escrow business relationship to comprehend the boosted costs of owning a home, aside from the cost of your mortgage loan. These boosted costs may include your homeowners insurance and any boosted insurance policies you demand (similar flood or earthquake insurance), real manor taxes or ground rent (depending on whether you own the country), and private mortgage insurance (if you are required to hold a PMI policy).

This means that when you brand your monthly mortgage payment, information technology will include your mortgage rate and these additional costs, like holding taxes and habitation insurance. Your mortgage visitor sets bated the portion of your payment intended for paying your home insurance visitor and boosted monthly payments and places these funds into your escrow account.

The mortgage lender so takes this coin and makes disbursements to pay for your homeowners insurance premiums and real estate taxes. This makes the payment process simpler for the homeowner, since you lot don't demand to worry about making your insurance payments or computing your belongings or county taxes. After you lot send your monthly mortgage payment to your mortgage lender, your piece of work is done.

What is escrow shortage?

Escrow accounts that last for the duration of your mortgage aid take the guesswork out of making monthly payments for your homeowners insurance and property taxes. Mortgage companies typically require these escrow accounts to concord 2 months' worth of payments as a cushion, but these costs can change unexpectedly based on factors similar your property value and credit score.

If any of your costs, too referred to as "escrow," increase at any fourth dimension, you lot volition exist left with an escrow business relationship shortage. This means that your escrow account may still have a positive residue (thanks to that required two-month absorber), but information technology does not have enough funds to cover the increased tax or insurance charge per unit in the future. These changes will increase your monthly escrow payments, leaving you responsible for covering the shortage corporeality.

The minimum residue you need in your escrow account changes every year—mostly due to holding tax or home insurance rate increases. For this reason, lenders conduct an escrow analysis once every 12-month flow to brand sure they're taking enough money from your monthly mortgage payments to hold in your escrow business relationship. This assay is based on the estimated costs of your dwelling house insurance and belongings tax assessment for the adjacent year.

If your mortgage lender's escrow analysis statement says that your escrow account residue is too high—meaning they took out besides much money from your mortgage payments in the previous year—they will refund yous the boosted money. But if your mortgage lender calculates that your escrow account balance is too low—meaning the lender did not take enough coin from your mortgage payments to embrace your insurance bills and taxation bills, likely because of an increase in your rates—yous accept what is known as an escrow deficiency. This means that you currently have a negative escrow account remainder. This is different from an escrow shortage, which implies that you will have a negative balance in the future if you do non increase your monthly escrow payments.

Escrow shortages occur any time your escrow account residual doesn't comprise sufficient funds to cover an increment in your escrow costs. An escrow deficiency, on the other hand, ways that your escrow account has a negative balance, and it only occurs following your mortgage lender's annual escrow analysis. In either instance, yous volition need to pay off the negative balance or the increment in your escrow business relationship's minimum residual.

Mortgage Escrow Shortage Payment

If y'all observe yourself in the case of an escrow shortage but have not yet reached a negative escrow business relationship balance, you will need to pay the deviation between your electric current account balance and the new monthly escrow payment corporeality. Nearly mortgage lenders require home buyers to have roughly two months' worth of escrow payments in their accounts.

Whether you find yourself facing escrow shortage or an escrow deficiency, in that location are generally two options for escrow shortage payments. You can brand either one lump-sum payment of the escrow shortage rest or monthly payments over a 12-calendar month period. The option yous choose simply depends on the amount you owe and your current financial situation.

If you tin can beget to pay your escrow shortage in one lump sum, it'south of import to annotation that your monthly escrow payment corporeality will likely nevertheless increase due to the increase in your service costs, whether it exist your property taxes or insurance rates.

While you can't change your local property tax rates to cut down on your escrow payments, at that place are still means to minimize your monthly payment costs.

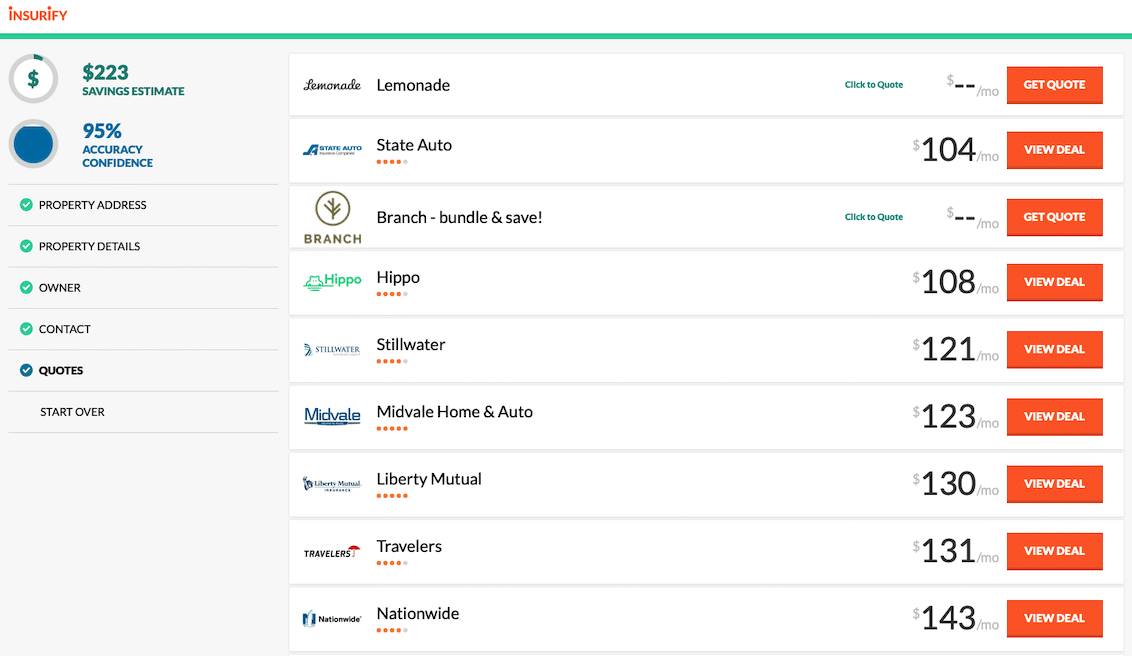

The easiest way to practise this is to shop around for cheap homeowners insurance. You tin compare homeowners insurance options to come across if you could go a amend homeowners insurance rate with a different company or policy.

Paying off an escrow shortage can seem like a daunting task. Insurify answered some of homeowners' nigh frequently asked questions about escrow shortages so you can decide what the best escrow payment option is for you.

Cutting Premiums, Non Coverage

Frequently Asked Questions - Escrow Shortage

Why do I have an escrow shortage?

Escrow shortages happen when your escrow costs (typically home insurance or property taxes) increase. You tin face an escrow shortage even if you still have funds in your escrow account, and you will be responsible for paying the newly increased monthly escrow rest or rate.

Should I pay my escrow shortage in full?

Whether y'all pay your escrow shortage in full or in monthly payments doesn't ultimately affect your escrow shortage balance for better or worse. Equally long as you make the minimum payment that your lender requires, you'll be in the clear. If you exercise choose to pay your escrow shortage in full, keep in mind that your monthly escrow payments volition likely still increase due to the increment of your homeowners insurance rates or property tax expenses.

Can I pay off my escrow shortage with a credit menu?

In brusque, probably not, and even if you tin can, it'south probably non the all-time option. Some mortgage lenders won't allow you to pay your escrow shortage with a credit bill of fare at all. For those lenders that practice take credit bill of fare payments, paying off your escrow shortage in one lump sum with a credit card will probably end upwardly beingness more expensive in the long run. If yous are concerned about affording your escrow shortage payments, the better option is to pay off your escrow shortage monthly with your mortgage lender. This manner, you can pay off the debt over a longer period of time, rather than draining all of your financial resources at in one case. And you won't need to incur boosted credit card fees or interest rates.

Why are my monthly escrow payments so high?

Monthly escrow payments are the combination of your homeowners insurance rate, your property taxes, and many additional costs associated with owning your home (like individual mortgage insurance). Since many mortgage lenders crave homeowners to take at least ii months' worth of these costs in an escrow account, monthly payments to cover these costs can get pretty pricey. But the rates associated with property taxes are out of your hands, so the best style to relieve on high monthly escrow payments is to shop around for a cheaper home insurance policy.

Escrow Shortage: The Bottom Line

Paying for a home is no pocket-sized task. If yous're a new homeowner, terms like "escrow accounts" and "shortage amounts" tin can brand you lot experience like you're in way over your caput. Plus, with fluctuating factors, like property taxes and dwelling house insurance rates, being largely out of your hands, information technology can experience like the price of your home is completely out of your control. Insurify helps you make it the know about your dwelling expenses and so you tin better empathize your escrow shortage and decide the best payback options for you. That way, y'all can cease stressing about the cost of your abode and can become back to enjoying information technology instead.

Use Insurify to find the best home insurance providers for your property. Our comparison tools brand homeowners insurance shopping (and saving) simple so y'all can be on your mode to enjoying your newly insured abode in no time.

Compare Quotes For Free

Compare & Save Today.

Source: https://insurify.com/blog/home-insurance/escrow-shortage/

Posting Komentar untuk "How to Know When You Should Pay Escrow or Principal"